Introduction

Here we use PyMC3 on two Bayesian inference case studies: coin-toss and Insurance Claim occurrence. My last post was an introduction to Baye’s theorem and Bayesian inference by hand. There we looked at a simple coin toss scenario, modelling each step by hand, to conclude that we had a bias coin bias with the posterior probability of landing tails P(Tails|Observed Data) = 0.36.

This time we will run: i) the same coin-toss scenario again, and ii) an example for Poisson insurance claim counts, using the probabilistic programming package PyMC3. An alternative would be to use the equally popular Stanford “Stan” package and its python wrapper PyStan. These packages provide an easy to use and intuitive frameworks for developing complex models of data generative processes. In addition, easy access to Markov Chain Monte Carlo sampling algorithms.

Method:

Recall that our initial approach to Bayesian Inference followed:

- Set prior assumptions and establish “known knowns” of our data based on heuristics, historical, or sample data.

- Formalise a Mathematical Model of the problem space and prior assumptions.

- Formalise the Prior Distributions.

- Apply Baye’s theorem to derive the posterior parameter values from observed sample data.

- Repeat steps 1-4 as more data samples are obtained.

Using PyMC3 we can now simplify and condense these steps down.

First, we set our prior belief and prior beta-binomial distribution.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

# prior estimates

from scipy.stats import beta

# prior belief of landing tails given coin is unbias

prior = 0.5

theta = np.arange(0,1.01,.01)

# beta-binomial prior distribution

a,b=7,7

prior_beta = beta(a,b)

prior_beta = prior_beta.pdf(theta) / prior_beta.pdf(theta).sum() # sample integral pmf

fig,axs = plt.subplots(1,1,figsize=(3,3))

axs.plot(theta,prior_beta,'b',label='Beta Prior')

plt.legend();

Second, we define and inspect our sample observation data

1

2

3

4

5

6

# observation data

trials = 50

tails = 15

heads = trials-tails

print(f"Trials:\t{trials}\ntails:\t{tails}\nheads:\t{heads}")

print(f'Observed P(tails) = {tails/trials}')

1

2

3

4

Trials: 50

tails: 15

heads: 35

Observed P(tails) = 0.3

Third, we define and run our mathematical model

Notice, PyMC3 provides a clean and efficient syntax for describing prior distributions and observational data from which we can include or separately initiate the model sampling. Also notice that PyMC3 allows us to define priors, introduce sample observation data, and initiate posterior simulation in the same cell call.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

import pymc3 as pm

with pm.Model() as model:

# Define the prior beta distribution

theta_prior = pm.Beta('prior', a,b)

# Observed outcomes in the sample dataset.

observations = pm.Binomial('obs',

n = trials,

p = theta_prior,

observed = tails)

# NUTS, the No U-Turn Sampler (Hamiltonian)

step = pm.NUTS()

# Evaluate draws=n on chains=n

trace = pm.sample(draws=500,step=step,chains=2,progressbar=True)

model

1

2

3

Multiprocess sampling (2 chains in 4 jobs)

NUTS: [prior]

Sampling 2 chains, 0 divergences: 100%|██████████| 2000/2000 [00:00<00:00, 2145.48draws/s]

Results

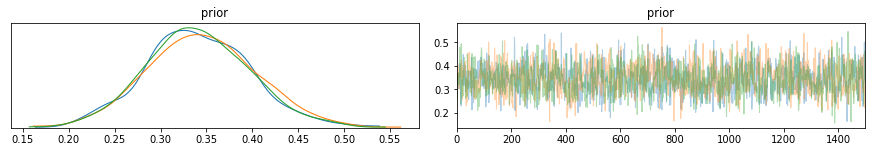

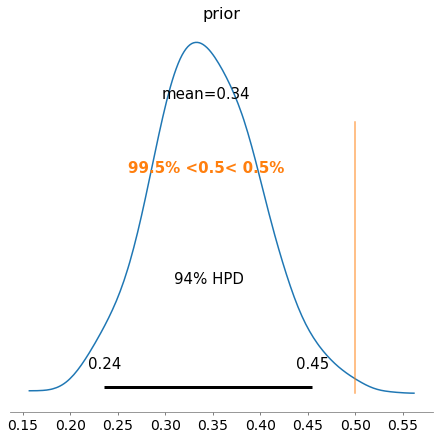

Or with more sampling and across more chains. Then the trace summary returns useful summary statistics of model performance:

- mc_error estimates simulation error by breaking the trace into batches, computing the mean of each batch, and then the standard deviation of these means.

- hpd_* gives highest posterior density intervals. The 2.5 and 97.5 labels are a bit misleading. There are lots of 95% credible intervals, depending on the relative weights of the left and right tails. The 95% HPD interval is the narrowest among these 95% intervals.

- Rhat is sometimes called the potential scale reduction factor, and gives us a factor by which the variance might be reduced, if our MCMC chains had been longer. It’s computed in terms of the variance between chains vs within each chain. Values near 1 are good.

1

2

3

4

5

with model:

# Evaluate draws=n on chains=n

trace = pm.sample(draws=1500,chains=3)

summary = pm.summary(trace)

summary

1

2

3

4

5

Auto-assigning NUTS sampler...

Initializing NUTS using jitter+adapt_diag...

Multiprocess sampling (3 chains in 4 jobs)

NUTS: [prior]

Sampling 3 chains, 0 divergences: 100%|██████████| 6000/6000 [00:01<00:00, 3186.22draws/s]

| mean | sd | hpd_3% | hpd_97% | mcse_mean | mcse_sd | ess_mean | ess_sd | ess_bulk | ess_tail | r_hat | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| prior | 0.343 | 0.057 | 0.236 | 0.455 | 0.001 | 0.001 | 1793.0 | 1793.0 | 1775.0 | 2832.0 | 1.0 |

We use the trace to manually plot and compare the prior and posterior distributions. Confirming these are similar to what was obtained by hand with a posterior distribution mean of P(Tails|Observed Data) = 0.35.

However, PyMC3 also provides functionality to create trace plots, posterior distribution plot, credible intervals, plus many more (e.g. see official docs and useful examples here).

1

2

3

4

5

6

# note there are a few user warnings on using pymc3.traceplot() with pyplot

import warnings

with warnings.catch_warnings():

warnings.simplefilter("ignore")

pm.traceplot(trace)

pm.plot_posterior(trace,ref_val=0.5);

And there we have it. PyMC3 and other similar packages offer an easy set of functions to assemble and run probabilistic simulations such as Bayesian Inference. Below I will show one more example for Insurance claim counts.

Case Study:

Evaluating Insurance claim occurrences using Bayesian Inference

Insurance claims are typically modelled as occurring due to a Poisson distributed process. A discrete probability distribution that gives the expected number of events (e.g. claims) to occurring within a time interval (e.g. per year). The Poisson distribution has many applications such as modelling machine component failure rates, customer arrival rates, website traffic, and storm events. First, we will run this through by hand as before and then using PyMC3.

The Poisson distribution is given by:

\[f(y_i|λ)=\frac{e^{−λ}λ^{y_i}}{y_i!}\]Where lambda λ is the “rate” of events given by the total number of events (k) divided by the number of units (n) in the data (λ = k/n). In the Poisson distribution the expected value E(Y), mean E(X), and variance Var(Y) of Poisson distribution are the same;

e.g., E(Y) = E(X) = Var(X) = λ.

Note that if the variance is greater than the mean, the data is said to be overdispersed. This is common in insurance claim data with lots of zeros and is better handled by the NegativeBinomial and zero-inflated models such as ZIP and ZINB.

First, establish the prior distribution

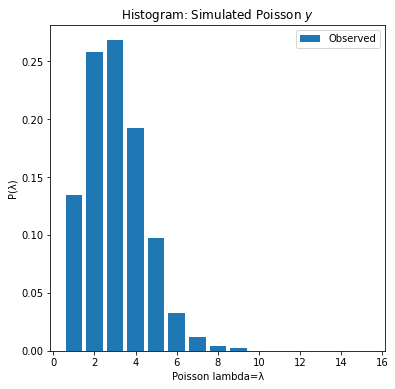

Here we generate some observed data that follows a poisson distribution with a rate, lambda, λ = 2.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

n = 1000

lam_ = 2

y = np.random.poisson(lam=lam_,size=n)

bins = np.arange(0,16,1)

print("Mean={:.2f}, Var={:.2f}".format(np.mean(y),np.var(y)))

# compute histogram

obs_,bins = np.histogram(y,bins=bins,density=True)

# plot

fig,axs = plt.subplots(1,1,figsize=(6,6))

axs.bar(bins[1:],obs_,label='Observed')

axs.set_title('Histogram: Simulated Poisson $y$')

axs.set_xlabel('Poisson lambda=λ')

axs.set_ylabel('P(λ)')

axs.legend();

1

Mean=2.04, Var=2.03

The observed poisson generated data has a right-skew “heavy tail”. It looks like a gamma distribution. The gamma-poisson model is a poisson distribution where λ lambda is gamma distribution. The gamma-poisson distributions form a conjugate prior.

We could use a beta-poisson, or any distribution that resembles the shape the observed lambda data, however gamma-poisson is most suitable as:

- poisson can take on any positive number to infinity(0,∞), whereas a beta or uniform is [0-100].

- gamma and poisson are in the same distribution family.

- gamma has a peak close to zero.

- gamma tail goes to infinity.

The gamma-poisson prior is then:

\[λ∼Γ(a,b)\]Where a is the gamma shape and b is the gamma rate parameter. The gamma density functions is:

\[f(λ)=\frac{b^a}{Γ(a)}λ^{a−1}e^{−bλ}\]where a>0 is the shape parameter,and b>0 is the rate parameter, and

\[E(λ)=\frac{a}{b}\]and

\[Var(λ)=\frac{a}{b^2}\]Note In scipy the gamma distribution uses the Shape a and Scale parameterisation, where rate b is equal to inverse of scale (rate = 1/scale). See more detail on scipy.gamma in the docs, and in these SO answers 1,2,3.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

# Parameters of the prior gamma distribution.

# shape, loc, scale == alpha,loc,beta

a, loc, b = stats.gamma.fit(data=y)

rate = 1/b # stats.gamma.fit(y)[2] == rate = 1/scale

print('Shape alpha:{:.2f}\nLoc:{:.2f}\nScale beta:{:.2f}\nRate:{:.2f}'.format(a, loc, b, rate))

# options for lambda

x = np.linspace(start=0, stop=15, num=100)

# Define the prior distribution.

prior = lambda x: stats.gamma.pdf(x, a=a, scale=rate,loc=0)

priors = prior(x)

# plot

axs.plot(x, priors, 'r-',label='Gamma')

axs.set_title('Prior Gamma-poisson density function for a={:.2f} and b={:.2f}'.format(a,b))

axs.set_xlabel('Poisson lambda=λ')

axs.set_ylabel('P(λ)')

axs.legend()

fig

1

2

3

4

Shape alpha:3.51

Loc:-0.76

Scale beta:0.80

Rate:1.25

Second, the likelihood function and posterior

The gamma function is often referred to as the generalized factorial since:

\[Γ(n+1) = n!\]1

2

3

4

5

6

import math

import scipy.special as sp

# generalised gamma == factorial

n = 3

sp.gamma(n+1) == math.factorial(n)

1

True

then the likelihood function is:

\[f(y|λ)=\prod_{i=1}^{n}\frac{e^{−λ}λ^{λ_i}}{y_i!} = \frac{e^{-nλ}λ\sum_{i=1}^{n}y_i}{\prod_{i=1}^{n}y_i!}\]then as

\[f(λ|y)∝λ^(\sum_{i=1}^{n}y_i+a)^{−1}e^{−(n+b)λ}\]the posterior distribution is again a gamma

\[f(λ|y)=Γ\big(\sum_{i=1}^{n}y_i+a,n+b\big)\]1

2

3

4

5

6

7

8

def posterior(lam,y):

shape = a + y.sum()

rate = b + y.size

return stats.gamma.pdf(lam, shape, scale=1/rate)

posterior = posterior(x,y)

1

2

3

4

plt.figure(figsize=(8, 6))

plt.plot(x, priors, 'r-', label='prior')

plt.plot(x, 0.1*posterior,c='blue', label='posterior')

plt.legend();

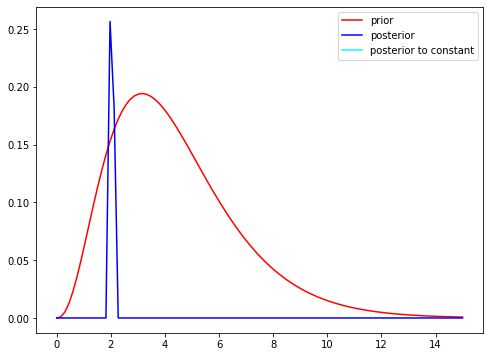

As shown the the posterior mean (blue) is centered around the true lambda rate that we set at the start. The posterior mean is:

\[\frac{\sum_{i=1}^{n}y_i+a}{n+b}\]i.e. the posterior mean is a weighted average of the prior mean and the observed sample average

\[\bar{y}\]1

2

3

4

5

print(f"""True lambda: {lam_}

prior mean: {a/b}

posterior mean: {(a+y.sum()) / (b+y.size)}

sample mean:{y.mean()}""")

1

2

3

4

True lambda: 2

prior mean: 4.406142620913817

posterior mean: 2.0408855867928644

sample mean:2.039

Now lets re-produce the steps above in PyMC3.

1

2

# known initial params

print(a,b,lam_,y.shape)

1

(3.5125841350931166, 0.7972016426387533, 2, (1000,))

1

2

3

4

5

6

7

8

9

10

11

12

13

14

model = pm.Model()

with model:

# Define the prior of the parameter lambda.

prior_lam = pm.Gamma('prior-gamma-lambda', alpha=a, beta=b)

# Define the likelihood function.

y_obs = pm.Poisson('y_obs', mu=prior_lam, observed=y)

# Consider 2000 draws and 3 chains.

trace = pm.sample(draws=2000, chains=3)

summary = pm.summary(trace)

summary

1

2

3

4

5

Auto-assigning NUTS sampler...

Initializing NUTS using jitter+adapt_diag...

Multiprocess sampling (3 chains in 4 jobs)

NUTS: [prior-gamma-lambda]

Sampling 3 chains, 0 divergences: 100%|██████████| 7500/7500 [00:02<00:00, 3101.04draws/s]

| mean | sd | hpd_3% | hpd_97% | mcse_mean | mcse_sd | ess_mean | ess_sd | ess_bulk | ess_tail | r_hat | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| prior-gamma-lambda | 2.04 | 0.045 | 1.954 | 2.124 | 0.001 | 0.001 | 2487.0 | 2485.0 | 2483.0 | 3839.0 | 1.0 |

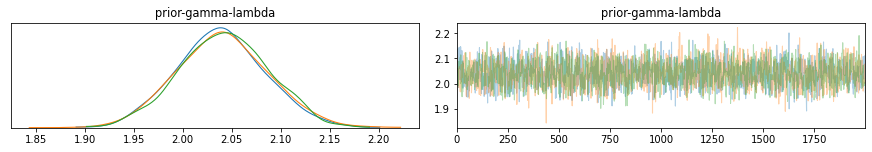

The above configuration simulates the posterior distribution for 3 independent Markov-Chains (traces). The traceplots display the results for each simulation.

Below the mean, quantile, credible interval (HPD) 94%, and arbitrary reference value (orange vertical).

1

2

3

4

5

6

# note there are a few user warnings on using pymc3.traceplot() with pyplot

import warnings

with warnings.catch_warnings():

warnings.simplefilter("ignore")

pm.traceplot(trace)

pm.plot_posterior(trace,ref_val=2.5);

You may have noticed that in this example that we have defined our prior distribution from the observed data and applied bayesian inference on this data to derive the posterior distribution, confirming a lambda of 2.

Conclusion:

In this post PyMC3 was applied to perform Bayesian Inference on two examples: coin toss bias using the beta-binomial distribution, and insurance claim occurrence using the gamma-poisson distribution.

References

- https://twiecki.io/blog/2015/11/10/mcmc-sampling/https://twiecki.io/blog/2015/11/10/mcmc-sampling/

- https://docs.pymc.io/https://docs.pymc.io/

- https://pystan.readthedocs.io/en/latest/index.htmlhttps://pystan.readthedocs.io/en/latest/index.html

- https://www.sciencedirect.com/science/article/abs/pii/S0740002005000249

- https://vioshyvo.github.io/Bayesian_inference/conjugate-distributions.html

- https://www.coursera.org/learn/mcmc-bayesian-statistics